As the pace of technological change accelerates, corporations are no longer just adapting to disruption — they are actively investing in it. Through their corporate venture capital (CVC) arms, established companies are entering partner-investor relationships with startups across frontier domains such as artificial general intelligence (AGI), humanoid robotics, quantum computing, and other potentially game-changing technologies.

In this post, I’m exploring how corporates are using CVC to de-risk exploration in these emerging tech domains, the competitive advantage of corporate-startup partnerships, which categories are particularly well suited to CVC versus traditional VC, and how emerging-tech startups can best position themselves for CVC investment.

How CVC reduces technology risk for corporations

Corporations face an inherent tension: they need to pursue innovation and new business models, but they also must manage risk, protect core business margins, and maintain operational stability.

That’s why more than 25% of the funding deals last year included CVCs. CVC offers a hybrid path: by investing in and partnering with startups in nascent and emerging technologies, corporates can explore adjacent or disruptive opportunities while externalizing much of the technology risk.

In domains such as AGI, quantum computing, space tech, or next-gen energy storage, the technologies are capital-intensive, have long horizons, involve high technical and commercialization risk, and often require domain-specific assets, manufacturing, regulatory engagement, or ecosystem partnerships. For corporations, investing via CVC is a strategic way to gain early exposure, build optionality, secure technology rights or vantage, and integrate promising startups into their ecosystem — enabling them to stay ahead of both disruptive threats and complementary opportunities.

However, not all companies should invest in all emerging technologies — the key is strategic selectivity, focusing on technologies that could either disrupt their industry or offer complementary capabilities to enhance their competitive position.

CVC is a de-risking engine for corporates exploring emerging tech — it lets them access options in high-uncertainty spaces without the full burden of building in-house, while building strategic alignment with their core business and future growth vectors.

How CVCs reduce technology risk through strategic value creation

While most emerging tech startups will need venture capital funding, nearly all funding deals can benefit significantly from CVC participation. The question isn’t whether corporate venture capital adds value, but rather how CVCs uniquely reduce technology risk for both corporates and startups across different technology categories.

What makes CVC different from traditional VC?

CVC brings strategic value beyond capital: manufacturing capabilities, distribution networks, supply chain access, regulatory expertise, and direct integration pathways. Traditional VC focuses primarily on financial returns and rapid scaling without operational entanglement.

Especially suited for CVC

Best for: Hardware, long horizons, strategic fit, high-capex technologies

- Hardware + embedded systems (e.g., humanoid robots, advanced compute, quantum computing, next-gen energy storage, nuclear energy) — These domains require supply chain, manufacturing, and integration with existing platforms, often with regulatory or domain-specific partnerships. Corporations with manufacturing or platform assets can add real value. For example, HP Tech Ventures’ investment in EdgeRunner AI demonstrates how corporates can accelerate AI hardware integration. EdgeRunner builds domain-specific, air-gapped, on-device AI agents for military and enterprise applications that operate entirely without internet connectivity. The company’s platform delivers mission-specific AI assistants that ensure low latency, enhanced data privacy, and reduced cloud costs — critical advantages that scale when coupled with AI hardware platforms and edge computing products and expertise. Similarly, Intel Capital’s investment in Rigetti Computing showcases how corporate backing accelerates quantum computing development. Rigetti builds full-stack quantum computers, and Intel’s expertise in chip manufacturing, supply chain access, and deep semiconductor knowledge provides strategic advantages that pure financial investors cannot match, reducing both technical and commercialization risk.

- Platform or ecosystem technologies (technologies that require broad industry adoption and create value through network effects, such as 6G/hyperconnectivity, clean-tech infrastructure etc.) — Corporates are often deploying or will deploy these platforms themselves, so investing via CVC gives them inside access and optionality.

- Strategic technology adjacencies for the corporate. For example, if a corporate sees synthetic biology or biotech as a future adjacency to their business, then CVC allows them to explore while leveraging internal capabilities (e.g., R&D, supply chain, global operations).

- High-capex / long-horizon technologies — Traditional VCs demand high returns within a fixed timeline, but corporates can afford longer horizons if strategic alignment is strong.

Related to the above, trending data show that CVCs have recently been prioritizing AI and Robotics, which exemplify both platform technologies and strategic adjacencies that many corporates are exploring. For example, nearly 30% of CVC deals in 2024 revolved around AI.

HP Tech Ventures’ recent investment in Multiverse Computing — a quantum-inspired AI company that compresses large language models by up to 95% while maintaining performance — exemplifies this trend. Multiverse’s technology addresses a critical infrastructure challenge in AI deployment, enabling models to run on edge devices and dramatically reducing computing costs and energy consumption.

HP’s strategic support helps Multiverse scale this technology across enterprise applications, bringing AI benefits to companies of all sizes.

Making it work for both CVC and startup

In the accelerating wave of frontier technologies — from AGI and quantum computing to next-gen energy storage, synthetic biology, and space tech — the smart corporates will not wait passively. They will deploy their CVC as a strategic lever to access, partner with, and accelerate startups that can redefine their future business models.

How do startups benefit from CVC partnerships?

For startups operating in these domains, the path to growth means not just securing capital, but forging the right strategic partnerships: ones that bring scale, integration, and access to a corporate ecosystem that would otherwise take years to build.

For HP Tech Ventures, this means offering portfolio companies access to HP’s world-class technology, one of the world’s largest channel and distribution partner networks, and a vast global manufacturing and supply chain — resources that help startups scale rapidly and achieve significant market impact.

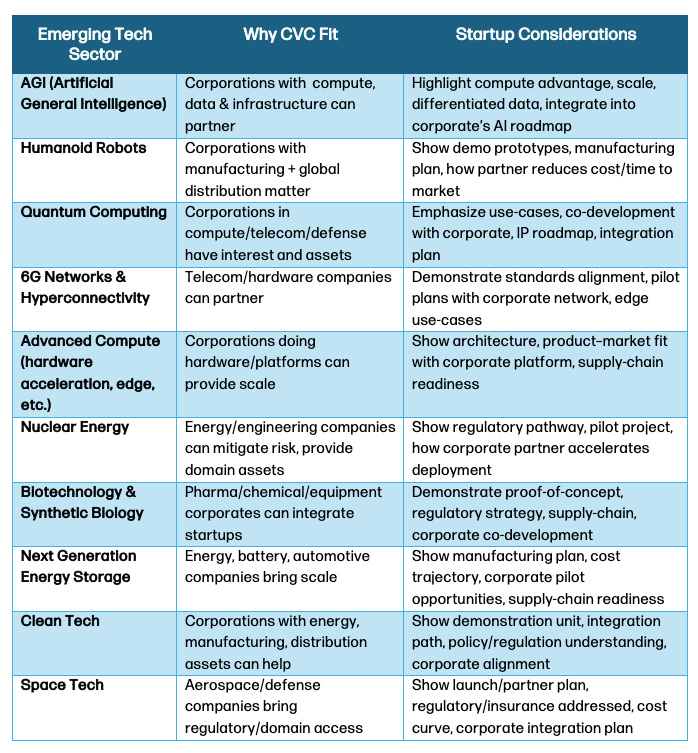

Emerging tech sectors alignment

From humanoid robots to synthetic biology, the next wave of innovation is rewriting the boundaries of what’s possible — and CVCs are uniquely positioned to shape that future. The following table maps how each major emerging-tech sector aligns with corporate venture capital, and what founders should keep in mind as they navigate this evolving landscape.

What should founders consider when pursuing CVC?

By aligning technology, business model, partner strategy, and timing, both corporations and startups can ride the emerging-tech wave with lower risk and higher impact.

If you’re a startup in one of these frontier domains and are thinking about CVC, ask yourself: Which corporations in my value chain have scale, distribution, or manufacturing that could accelerate me? How much risk are they willing to take? Am I ready for strategic integration?